how to pay indiana state taxes quarterly

After making the payment you can see the status by clicking on Look up Payment on the IRS Direct Pay website. As a self-employed individual you file an annual return but usually pay estimated taxes every quarter.

So you should familiarize yourself with how those taxes break down.

. This means you may need to make two estimated tax payments each quarter. For more information call 317 232-5500. These regular tax payments are meant to cover Medicare Social Security and your income tax.

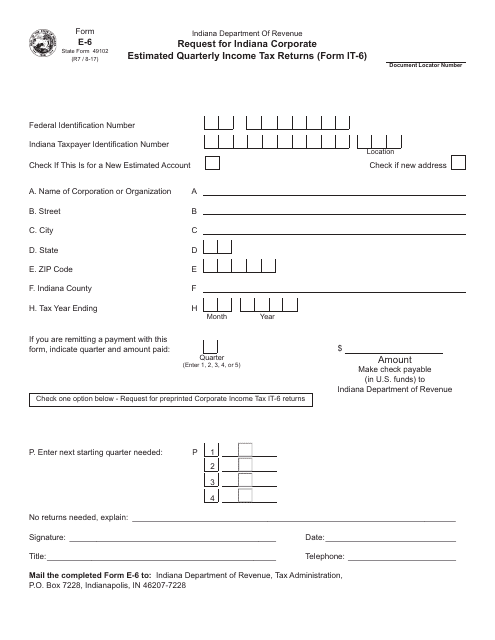

17 2023 Mail entire form and payment to. Employees fill out Indiana Form WH-4 Employees Withholding Exemption and County Status Certificate to be used when calculating. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

Payment Listen Use the links below to pay your current Delaware tax return with balance due a delinquent tax bill a quarterly estimated tax or a quarterly or. Estimated payments can be made by one of the following methods. EFT allows our business customers to quickly and securely pay their taxes.

15 2022 4th Installment payment due Jan. You have the option of paying the entire years estimated taxes on this date or you can make 4 payments. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax.

Indiana State Payroll Taxes What are my state payroll tax obligations. One to the IRS and one to your state. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form.

To learn more about the EFT program please download and read the EFT Information Guide. This payment covers your taxes on income during the first quarter of the calendar year from January 1 through March 31. The first due date for quarterly income tax payments is April 15.

March 30 2022 Manuel J. There are several ways you can pay your Indiana state taxes. That breaks down to 124 Social Security tax and 29 Medicare tax.

Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. But you have a 3000 over-payment from the previous tax year. DORpay remains available to make single payments on tax bills due for the following tax types until July 8 2022.

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. For example lets say youre required to make quarterly payments of 4000 each. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

Quarterly taxes generally fall into two categories. However some counties within Indiana have an additional tax rate making the combined tax rate ranging from 373 percent to 613 percent. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

While some tax obligations must be paid with EFT several thousand businesses use the program for its speed and convenience. Income tax follows the same income tax rates as salaried workers pay. Different states have different rules and rates for UI taxes.

After that time payments will no longer be accepted through DORpay and will need to be made using INTIME beginning July 18 2022. If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317-232-2165. Paying your state.

Here are the basic rules for Indianas UI tax. If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. Installment Period Information Place an X in the appropriate box to show which payment you are making.

Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. If the due date falls on a national or state holiday Saturday or Sunday payment postmarked by the day following that holiday or Sunday is considered on time. Indiana requires employers to withhold income taxes from employee paychecks in addition to employer paid unemployment taxesFind Indianas tax rates here.

In Indiana state UI tax is just one of several taxes that employers must pay. Every state has different requirements for this but its usually also quite painless. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

The penalties are calculated using a complex formula that encompasses factors relating to interest rates and investment yields on the state general fund. A representative can research your tax liability using your Social Security number. Line I This is your estimated tax installment payment.

Learn about state requirements for estimated quarterly tax payments. Line I This is your estimated tax installment payment. The self-employment tax rate on net income up to 142800 for tax year 2021 is 153.

1st Installment payment due April 18 2022 2nd Installment payment due June 15 2022 3rd Installment payment due Sept. Box 6102 Indianapolis IN 46206. You can check specific county rates listed by the Department of Revenue.

Indiana Department of Revenue PO. Paying the IRS Federal The easiest way to make a federal quarterly tax payment is to use IRS Direct Pay. Some states also require estimated quarterly taxes.

The income tax and the self-employment tax. You can pay for your estimated taxes if you have an over-payment from the previous tax year. INtax only remains available to file and pay the following tax obligations until July 8 2022.

The Indiana income tax rate is set to 323 percent. Then the self-employment tax clocks in at 153. The penalty information can be found in Section IC 6-81-10-1 of the Indiana Tax Code.

Penalties will accrue for any business that fails to pay taxes or for a business that commits fraud. If your state collects income taxes youll need to also make a state estimated tax payment. Any employees will also need to pay state income tax.

Visit IRSgovpayments to view all the. Bojorquez of Anaheim California was sentenced to 36 months of probation with 18 months to be served on home confinement and ordered to pay over 33 million in restitution for offering and paying kickbacks to physicians to prescribe compounded medications. January 15 of the following year for September October November and December.

This payment covers your taxes on income during the first quarter of the calendar year from January 1.

Quarterly Tax Calculator Calculate Estimated Taxes

How To Pay Quarterly Income Tax 14 Steps With Pictures

Indiana Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

How To Pay Quarterly Income Tax 14 Steps With Pictures

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Templateroller

Economic Nexus Laws By State Taxconnex

Dor Keep An Eye Out For Estimated Tax Payments

Tax Penalties Here S What To Do If You Can T Pay Your Taxes This Year Abc7 Chicago

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Quarterly Tax Calculator Calculate Estimated Taxes

How To Pay Quarterly Income Tax 14 Steps With Pictures

Download Instructions For Form St 103 Sales Tax Vouchers And Or Electronic Funds Transfer Credit Recap Pdf Templateroller

Download Instructions For Form St 103 Sales Tax Vouchers And Or Electronic Funds Transfer Credit Recap Pdf Templateroller